Unlocking Rewards: A Deep Dive into the Uncover 5% Calendar and Maximizing Your Money Again

The world of bank cards is a posh panorama, full of various rewards buildings, rates of interest, and charges. Navigating this panorama could be daunting, however for savvy shoppers, it additionally presents a chance to strategically maximize their spending and earn vital rewards. One of the in style and efficient methods for reaching that is using a bank card with a rotating 5% money again calendar, and Uncover’s providing is a main instance. This text will delve deep into the Uncover 5% Calendar, exploring its mechanics, advantages, limitations, and methods for maximizing your money again potential.

The world of bank cards is a posh panorama, full of various rewards buildings, rates of interest, and charges. Navigating this panorama could be daunting, however for savvy shoppers, it additionally presents a chance to strategically maximize their spending and earn vital rewards. One of the in style and efficient methods for reaching that is using a bank card with a rotating 5% money again calendar, and Uncover’s providing is a main instance. This text will delve deep into the Uncover 5% Calendar, exploring its mechanics, advantages, limitations, and methods for maximizing your money again potential.

What’s the Uncover 5% Calendar?

The Uncover 5% Calendar is a rotating rewards program provided by Uncover bank cards just like the Uncover it® Money Again and Uncover it® Chrome. It permits cardholders to earn 5% money again on purchases made inside particular spending classes every quarter. Not like flat-rate money again playing cards that supply a constant share on all purchases, the Uncover 5% Calendar focuses on offering larger rewards in focused areas, encouraging strategic spending and maximizing returns.

How Does the Uncover 5% Calendar Work?

The calendar rotates quarterly, which means that the eligible classes for five% money again change each three months. Uncover publicizes these classes upfront, giving cardholders time to plan their spending accordingly. This is a breakdown of the important thing facets:

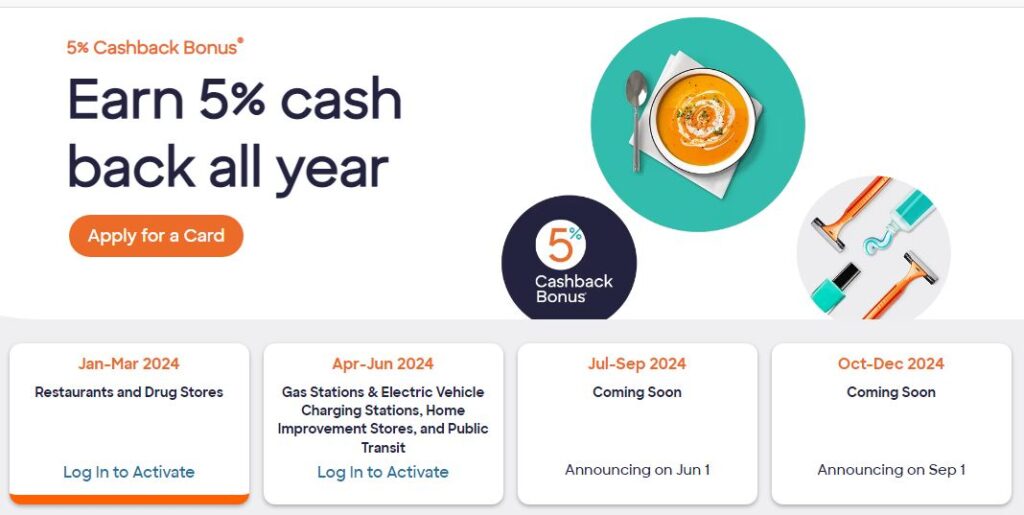

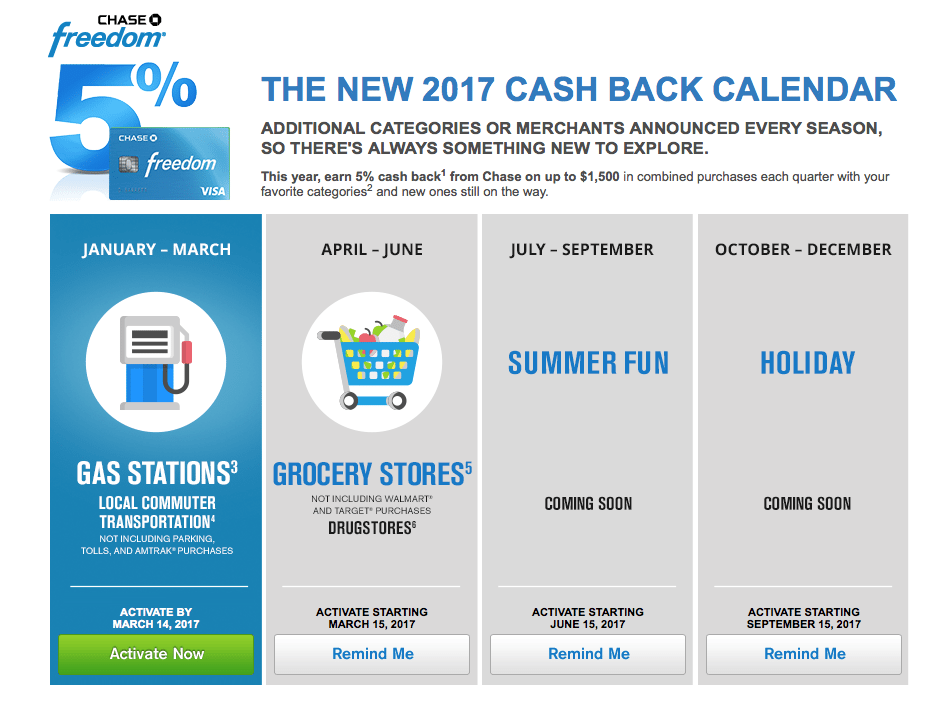

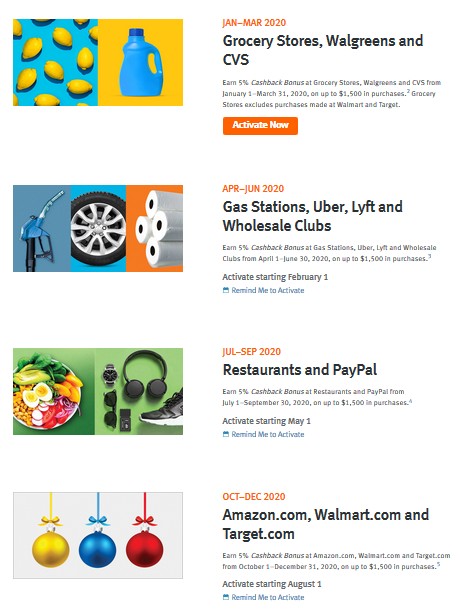

- Quarterly Rotation: The calendar options 4 distinct classes all year long, every lasting for one quarter (January-March, April-June, July-September, and October-December).

- Class Announcement: Uncover usually publicizes the upcoming classes a number of weeks earlier than the beginning of every quarter, permitting cardholders to anticipate and regulate their spending habits.

- Activation Required: To earn the 5% money again, cardholders should manually activate the bonus classes every quarter by way of their Uncover account, both on-line or by way of the cell app. This activation is essential, as purchases made throughout the eligible classes with out activation will solely earn the bottom money again charge (usually 1%).

- Spending Restrict: Every quarter, there is a spending restrict on the quantity eligible for the 5% money again. This restrict is normally set at $1,500 in mixed purchases for the quarter. As soon as this restrict is reached, all subsequent purchases throughout the class earn the bottom money again charge.

- Base Money Again Fee: Purchases exterior the 5% classes, or these exceeding the quarterly restrict, earn a normal money again charge. This charge is usually 1% for many Uncover money again playing cards.

- Money Again Redemption: Uncover provides numerous choices for redeeming earned money again, together with assertion credit, direct deposits to a checking account, digital present playing cards, and purchases on Amazon.com.

Advantages of Utilizing the Uncover 5% Calendar:

The Uncover 5% Calendar provides a number of compelling advantages for cardholders:

- Excessive Money Again Potential: Incomes 5% money again on particular classes can considerably enhance your total rewards earnings in comparison with a flat-rate card.

- Strategic Spending: The rotating classes encourage you to suppose strategically about your spending and prioritize purchases throughout the bonus classes to maximise your returns.

- Flexibility: Uncover’s various redemption choices let you select the tactic that most accurately fits your wants and monetary objectives.

- No Annual Payment: Many Uncover money again playing cards, together with the Uncover it® Money Again, include no annual price, making them a cheap possibility for incomes rewards.

- Introductory Affords: Uncover typically provides engaging introductory bonuses and advantages, comparable to money again match applications, which may additional improve the worth of the cardboard.

- Credit score Constructing Alternative: Accountable use of a Uncover card can assist construct or enhance your credit score rating, making it a helpful software for monetary well being.

- Fraud Safety and Safety: Uncover supplies strong fraud safety and safety features to safeguard your account and private info.

Limitations of the Uncover 5% Calendar:

Whereas the Uncover 5% Calendar provides quite a few benefits, it is vital to pay attention to its limitations:

- Rotating Classes: The altering classes require you to actively monitor and regulate your spending habits, which could be inconvenient for some customers.

- Spending Restrict: The quarterly spending restrict restricts the quantity of purchases eligible for the 5% money again, doubtlessly limiting your total earnings.

- Activation Requirement: Forgetting to activate the bonus classes will lead to lacking out on the 5% money again, lowering the cardboard’s worth.

- Restricted Class Choice: The classes provided every quarter might not align along with your spending habits, lowering the cardboard’s relevance throughout sure durations.

- Base Money Again Fee: The 1% base money again charge is comparatively low in comparison with another playing cards, making it much less engaging for on a regular basis purchases exterior the bonus classes.

- International Transaction Charges: Uncover playing cards usually cost international transaction charges, making them much less supreme for worldwide journey or on-line purchases from international retailers.

Methods for Maximizing Your Money Again with the Uncover 5% Calendar:

To actually leverage the ability of the Uncover 5% Calendar, take into account implementing these methods:

- Plan Forward: Evaluate the upcoming classes as quickly as they’re introduced and establish how one can align your spending accordingly.

- Prioritize Bonus Classes: Focus your spending on the 5% classes at any time when attainable, shifting purchases that you’d usually make with one other card.

- Activate Promptly: Set reminders to activate the bonus classes initially of every quarter to keep away from lacking out on the upper money again charge.

- Observe Your Spending: Monitor your spending throughout the bonus classes to make sure you do not exceed the quarterly restrict.

- Make the most of A number of Playing cards: Think about pairing your Uncover card with different playing cards that supply sturdy rewards in numerous classes to cowl all of your spending wants.

- Think about Reward Playing cards: In the event you anticipate future spending in a bonus class, buy present playing cards in the course of the quarter to lock within the 5% money again and use them later.

- Mix with Different Affords: Search for alternatives to mix your Uncover card with different reductions, coupons, or promotions to additional maximize your financial savings.

- Redeem Correctly: Select the redemption possibility that finest aligns along with your monetary objectives. Assertion credit can assist cut back your steadiness, whereas direct deposits can present additional money for different bills.

- Take Benefit of Introductory Affords: If you’re a brand new cardholder, make sure to take full benefit of any introductory bonuses or advantages provided by Uncover.

- Pay Your Stability in Full: To keep away from curiosity costs and keep a superb credit score rating, at all times pay your steadiness in full every month.

Examples of Frequent Uncover 5% Calendar Classes:

Through the years, Uncover has provided quite a lot of classes for its 5% money again calendar. Listed below are a number of the commonest and recurring examples:

- Fuel Stations: A frequent and in style class, permitting you to earn 5% money again on gasoline purchases.

- Eating places: One other extremely sought-after class, overlaying eating at eating places, cafes, and fast-food institutions.

- Grocery Shops: A staple class, providing 5% money again on groceries bought at supermarkets and grocery shops.

- Amazon.com: A recurring class, permitting you to earn 5% money again on purchases made on Amazon.com.

- PayPal: A more moderen addition, providing 5% money again on purchases made by way of PayPal, offering flexibility for on-line purchasing.

- Digital Wallets (e.g., Apple Pay, Google Pay, Samsung Pay): One other more and more widespread class, encouraging using cell cost strategies.

- Wholesale Golf equipment (e.g., Costco, Sam’s Membership): Providing rewards on bulk purchases at warehouse golf equipment.

- Choose Streaming Providers: Generally included, providing rewards on subscriptions to in style streaming platforms.

Is the Uncover 5% Calendar Proper for You?

The Uncover 5% Calendar is a helpful software for incomes money again, nevertheless it’s not essentially the most suitable choice for everybody. Think about the next elements when deciding if it is the precise selection for you:

- Spending Habits: Do you spend a major sum of money within the classes provided by the Uncover 5% Calendar?

- Group and Planning: Are you keen to trace the rotating classes and regulate your spending accordingly?

- Credit score Rating: Do you might have a superb or wonderful credit score rating to qualify for a Uncover card with favorable phrases?

- Redemption Preferences: Do you like the redemption choices provided by Uncover?

- Various Playing cards: Have you ever thought-about different money again playing cards with flat-rate rewards or extra constant bonus classes?

Conclusion:

The Uncover 5% Calendar supplies a compelling alternative to earn vital money again rewards by strategically aligning your spending with the rotating bonus classes. By understanding the mechanics of the calendar, maximizing your spending throughout the eligible classes, and avoiding widespread pitfalls, you possibly can unlock the total potential of this program and reap the monetary advantages. Whereas it requires some planning and group, the rewards could be properly definitely worth the effort for savvy shoppers trying to maximize their money again earnings. Earlier than making use of, rigorously take into account your spending habits and evaluate the Uncover card with different choices to make sure it aligns along with your particular person wants and monetary objectives. Bear in mind to at all times use credit score responsibly and pay your steadiness in full every month to keep away from curiosity costs and keep a wholesome credit score rating.